January 12th Market Update

📊1st Market Update of 2026 and final recap of 2025 stats for Columbia County, NY and some brief thoughts on affordability and where the market might be headed in 2026.

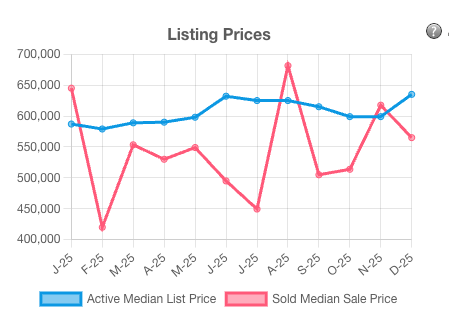

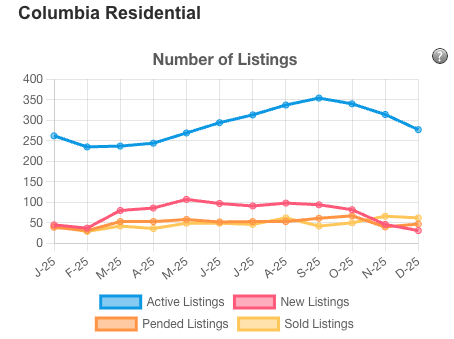

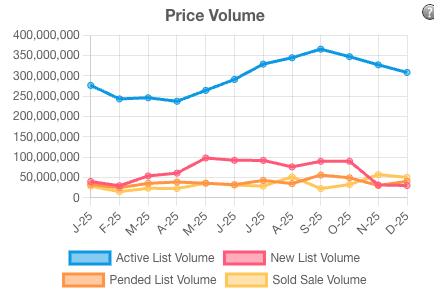

The Median sale price in December was $565,000 which was down 11% over December 24. At Year end the median sale price is $539,950 up 7.45% over 2024. December was another big month for closings… 62 homes sold in December, 16 more than December 2024 and only 4 less than November. Year to Date 574 Homes sold thru December which was an increase of only 18 sales or 3.2% from 2024. The last two months have made up for the decline in sales we saw for the majority of 2025.

31 new listings hit the market in December, 12 less than last December and -15 less than November. Despite the seasonal decline we saw over the past few months, for the year the number of new listings was up 1.4% or 12 listings compared to 2024.

47 Homes placed under contract in December, 4 more than last December and 8 more than the previous month of November. Year to date homes going under contract is up +5.9% compared to LY

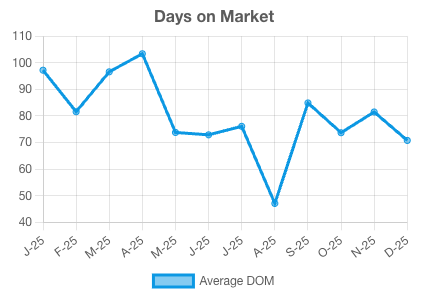

Average days on market was 70, a decrease of 18 days compared to previous year. The sale price to list price ratio was 96% in December, a 2.6 point decline from last December showing price negotiations are happening and price growth is slowing.

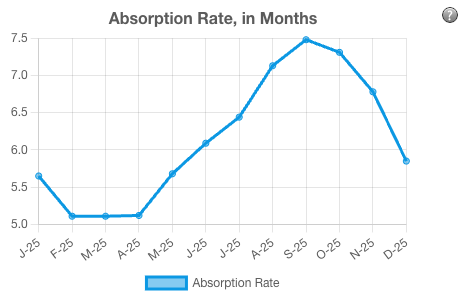

Coming out of December there was 5.85 months of inventory available, down -10.28% compared to last December with 6.52 months of inventory but this is still considered a balanced Market.

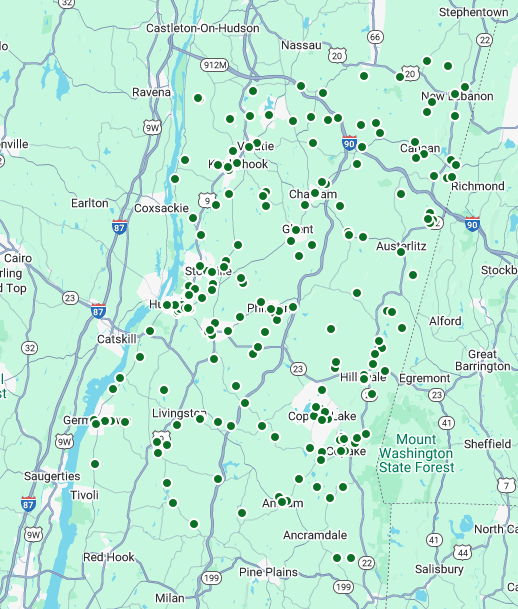

Ok fast forward back to today. The median list price today is $579,000. There are currently 218 homes on the market. 104 homes or 48% of all homes are sitting between 300-750k, which is where 48% of all sales have happened in 2025. 53 homes or 24% of all inventory is over $1M but this price range saw only 16.7% of all sales in 2025. Expired, withdrawn and canceled listings jumped at the end of the year as some sellers pull their homes off the market for the “slower” winter season. Between that and a jump in sales in November and December, the available inventory has declined 39% from peak levels in September. This is typical for the season in this region.

Active listings in Columbia County 1/11/26

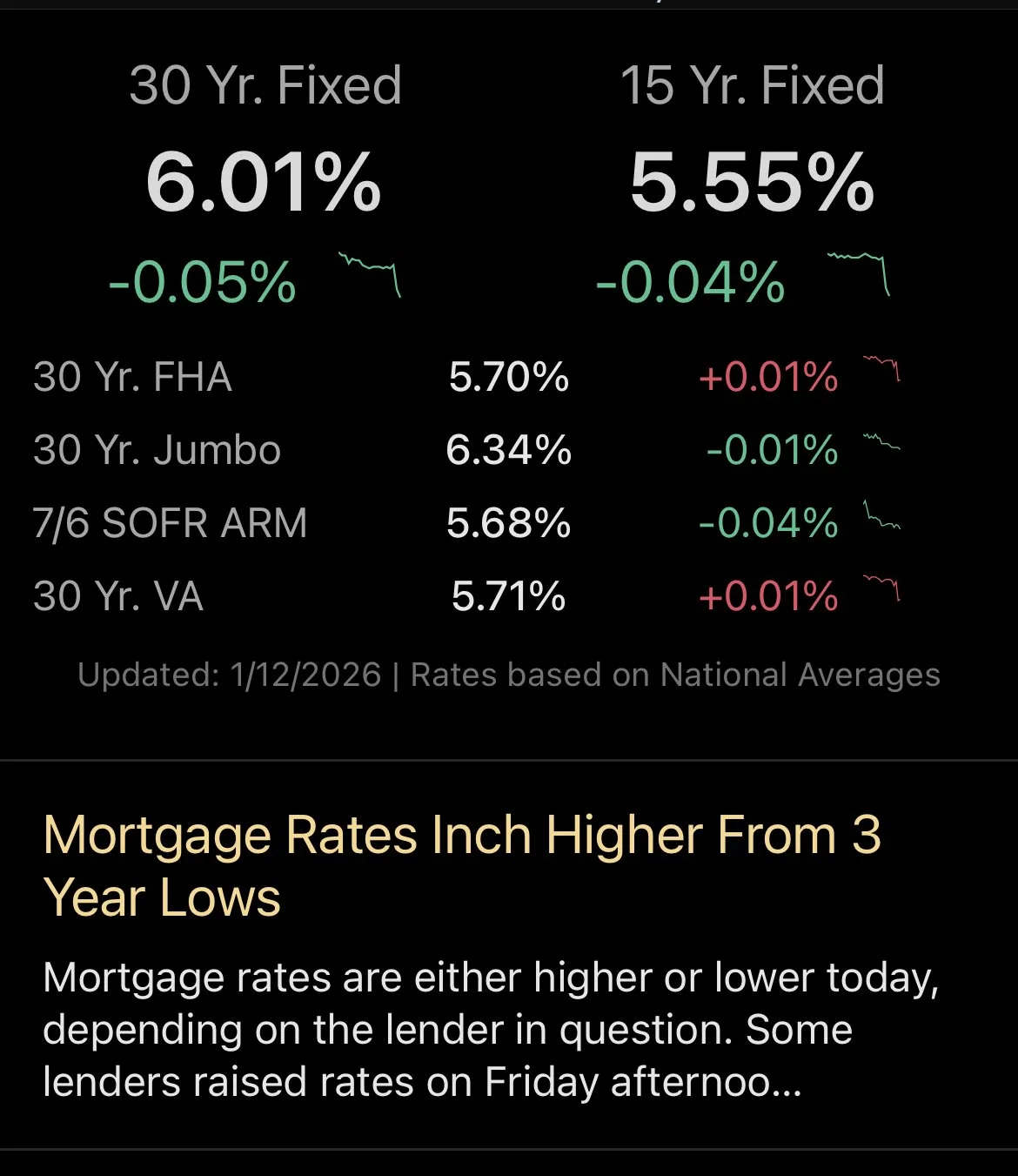

On Friday we saw mortgage rates dip under 6% but by Saturday they were back up above 6% again. Experts have projected that interest rates will remain stable just above 6% for most of 2026. But we saw on Friday that downward movement is possible, so if you want to be able to take advantage of that volatility next time, you have to have your ducks in a row. If you have already made and received an accepted offer, you need to have completed your mortgage app or already been pre-approved to be able to lock in a rate, If you’re shopping, you need to be pre-approved to expedite the process once you make an offer. If you already have a mortgage and just want to refinance, get in touch with a lender now so that the next time rates slide, you can take advantage.

There is lots of talk about improving affordability in the housing market from banning institutional investors from buying up SFHs to Fannie and Freddie buying 2B in MBS, to the latest threats from the DOJ against Jerome Powell, the Fed Chair. Unfortunately none of these actions actually address the supply issue with housing. In the this region specifically, there is not large scale housing construction and there is a shortage of homes in the median price range or below in a lot of towns. Lowering Mortgage rates makes purchasing homes more affordable on paper, but if more buyers are competing for the same housing stock, that has the potential to drives up prices. Stable rates should encourage more sellers to enter the market, increasing available inventory. This combination will keep prices stable supporting a balanced housing market. Let me know what you think in the comments below.

If this is the year you want to make a move, it’s time to get organized. Whether you are buying or selling, give me a call to discuss a strategy to help you achieve your 2026 real estate goals

*Data from HVCRMLS on 1/11/26

#colombiacountyrealestate #jensesmarealestate #beachandbartolorealtors #marketupdate